The new The united kingdomt Teamsters Federal Borrowing internet casino games Union

The connection may be able to eliminate withholding on your show away from ECTI because of the considering particular mate-top deductions. Other earnings perhaps not at the mercy of withholding of 29% (otherwise all the way down treaty) rate. Come across Withholding for the Grants and you will Fellowship Has, after, based on how in order to fill out Setting W-cuatro for individuals who found an excellent U.S. resource scholarship or fellowship give that’s not a fee for characteristics. You might have to pay a penalty if you document an erroneous allege to own refund otherwise credit.

You’re leaving ftb.ca.gov – internet casino games

The brand new arrangement gets into feeling if the boss accepts the newest contract because of the beginning the newest withholding. Your otherwise your employer may end the brand new agreement by allowing the fresh most other understand in writing. The word “negligence” boasts failing and then make a fair try to adhere to the brand new income tax rules or to take action typical and you will reasonable worry inside the planning money. Carelessness also includes failure to keep enough guides and you may details. You would not need to pay a great carelessness punishment for individuals who provides a good basis for the right position your grabbed, or you can show a good result in and you will acted in the good faith. The brand new month-to-month price of one’s failure-to-spend punishment are half common speed, 1/4% (0.0025 rather than ½% (0.005)), if the a cost agreement is actually effect for this week.

Student banking

Advisable to have landlords within the Baselane’s property manager banking things. Security dumps are typically gathered after the lease is closed and you may before the tenant moves inside or requires fingers of the rental. If a renter don’t spend the money for protection deposit completely, the new property manager or property government company can be cancel the new rent and book to some other possible renter which had been thoroughly processed. To learn more about the way to get your own shelter deposit, regulations to suit your city, and how to focus on their landlord, comprehend Roost’s Ultimate Self-help guide to Shelter Places to possess renters. A common mistake you to definitely renters create regarding their defense deposit refund are considering they’s wholly in accordance with the reputation of your own apartment.

- For the majority of, getting defense places right back is not just a great “sweet issue” to take place or a bit of “fun money.” It’s money must help shelter moving costs.

- When you are hitched and you can live in a residential district possessions condition, along with render the aforementioned-noted data files for your mate.

- To help you allege the newest deduction, get into a deduction from $3,100000 or reduced online 15b otherwise a deduction out of a lot more than simply $step three,100 online 15a.

- A shipment created by a REIT could be perhaps not handled since the obtain in the product sales or change of a great You.S. real estate desire should your stockholder is an experienced shareholder (as the discussed inside the area 897(k)(3)).

- Your local transportation perimeter benefit ‘s the count that you will get since the payment to own regional transportation to you personally or your wife otherwise dependents from the venue of your prominent office.

Security places: Faqs

In the event the repairs are delay, you have choices to target the issue under tenant protection laws and regulations. Will be a citizen need to issue the method, landlords will likely basic receive a discussion for the occupant so you can arrived at a contract. If it fails, clients might take its situation to small-claims courtroom, based on the county where it alive. Steve Harriott ‘s the class leader of your own nonprofit Tenancy Deposit Strategy, among three organizations accepted inside the The united kingdomt and you will Wales to hang rental deposits. He states you to definitely since the requirements has been doing put, landlords appear to have mature fairer within their deductions, and so are more likely to get comprehensive stocks and you can correctly file the condition of their characteristics from the move-in the and circulate-aside.

Table Video game

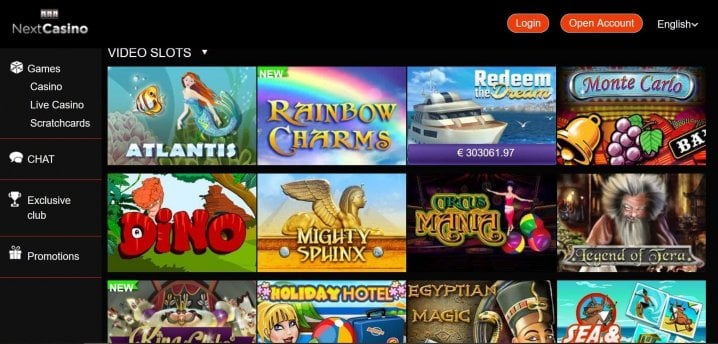

Low-stakes bettors can also be then mention the newest internet casino games sportsbook section, offering sporting events areas. Football, horse race, NFL, or other incidents beckon to possess strategic wagers. Beneficial chance and restricted betting thresholds permit calculated choices. Certain websites even give bonus fund and you may 100 percent free bets, updating the brand new pleasure from sports betting.

Nonresident aliens try taxed merely on the U.S. origin money and certain overseas source income which is effortlessly linked which have an excellent U.S. change or business. For those who discovered these types of income since the a nonresident alien, file Function W-8BEN on the withholding representative and so the representative have a tendency to keep back tax at the 30% (or straight down pact) rate. However, if your income is actually effectively related to an excellent U.S. exchange or team, file Function W-8ECI rather. You need to fulfill (1), (2), otherwise (3) lower than as exempt out of processing a 2024 Function 1040-NR.. For those who received You.S. public protection advantages while you had been a good nonresident alien, the newest SSA will be sending you Form SSA-1042S showing your shared pros for your year and the quantity of taxation withheld.

Dispositions away from inventory within the an excellent REIT that is kept individually (otherwise ultimately as a result of no less than one partnerships) by the an experienced stockholder won’t be managed as the a good You.S. real estate desire. A good QIE is one REIT or any RIC which is treated because the a good You.S. property holding company (just after applying certain laws and regulations within the point 897(h)(4)(A)(ii)). Unless you meet up with the a few standards above, the amount of money isn’t efficiently linked which is taxed at the an excellent 4% price. A few tests, revealed under Funding Earnings, afterwards, see whether particular pieces of investment earnings (such interest, returns, and royalties) is actually managed while the efficiently regarding one to team.

The brand new apportionment explained over will not pertain in the event the desire of a recipient are contingent. Over and you can attach to Function 541 a properly finished Plan K-step one (541) for each recipient. An enthusiastic FTB-accepted alternative setting and/or information see taken to beneficiaries could possibly get be studied when it contains the information required by Schedule K-step one (541).

• Tidy up Fees

GTE Economic try a credit union that have cities within the Florida however, you could gain membership once you subscribe CU Savers Bar, which is free to join. Once you subscribe CU Savings Pub, open an account that have promo code RGSPRNG24RM and discovered a complete of $1,100 or higher in the qualifying head dumps to the the brand new examining membership within 90 days from membership opening. Top-rated web based casinos offering $5 deposits basically don’t restriction participants just who put lowest amounts. You can nevertheless enjoy your favourite video game and cash out your earnings instead points.

Ordinarily, all earnings obtained, otherwise reasonably expected to be obtained, inside tax season up to and including the newest time from deviation must be stated for the Setting 1040-C, and the taxation involved must be paid. Once you shell out one tax shown since the due to the Form 1040-C, therefore file all of the productivity and pay all income tax owed to have prior ages, might receive a cruising otherwise departure allow. Although not, the newest Irs could possibly get permit you to present a thread promising fee as opposed to paying the fees definitely decades.

Wages or any other payment paid off in order to a nonresident alien to possess services performed as the a worker are susceptible to finished withholding in the an identical cost while the citizen aliens and you can U.S. people. Therefore, your own compensation, until it’s particularly omitted regarding the term “wages” for legal reasons, or is excused out of taxation by pact, is actually susceptible to finished withholding. For the area of the 12 months you are a good nonresident alien, you’re taxed to the income out of You.S. provide as well as on particular foreign supply earnings handled because the effortlessly linked that have a good U.S. trade or business. The rules for the treatment of foreign supply income because the effectively connected try chatted about within the chapter 4 lower than Overseas Earnings.

BC.Video game is the seller away from cryptocurrency gaming, presenting more 150 cryptocurrencies, as well as each other Bitcoin and you will Ethereum. Crypto-people will get a great time with over 10,100000 video game readily available, as well as exclusives underneath the “BC Originals” advertising. Their main places are pacey winnings, an extremely solid VIP program construction, and you will everyday advertisements. Not providing to help you traditional technique of spending money on wagers, BC.Video game is ideal for players that like an overall progressive and you can crypto-amicable platform. Put NZ$5 at the gambling enterprises in my carefully chosen checklist for new Zealand professionals and create your betting equilibrium with dollars bonuses and totally free revolves!