The Definition of “Traceable Costs”

The first are traceable costs directly tied to a particular product line or channel, such as direct materials and labor. The second are non-traceable or indirect costs that aren’t tied to a particular plant, customer or product. From there, they can allocate the drivers to various products/SKUs, customers and channels. These costs cannot be avoided and so must be paid even when there is no revenue coming in. Common examples of fixed costs include rent, salaries, insurance, and interest on loans.

Sequential Method in Accounting

ABC offers a comprehensive understanding of cost allocation, maximizing profitability and steering businesses to optimize their service delivery processes. In manufacturing, ABC generates cost figures that accurately reflect the expenditure on production by broadening the scope of overhead analysis and reconfiguring indirect cost associations. In the service industry, ABC offers a clearer understanding of cost objects and the activities that drive resource consumption, enabling service providers to re-evaluate pricing strategies and service proficiencies.

- Its implementation plays a key role in cost management and the development of sound financial strategies that help businesses to thrive, especially in the sphere of product manufacturing.

- However, EVATM still depends on historical data, while shareholders are ultimately concerned with future performance, and future cash flows.

- However, the value of any comparison (ROCE; ROI) will be affected by the similarities (or differences) between the entities whose performance is being measured.

- That is, some costs which are indirect for a product, may be traced to a segment or department and thus, will be direct costs for that department.

- By shifting the cost burden from high-volume items to low-volume ones, ABC recognizes the diverse activities essential to the production process, ensuring a more reliable costing system.

Understanding the Importance of Cost Traceability Analysis

In this section, we will discuss some of the methods and tools for identifying cost sources, as well as some of the challenges and benefits of doing so. Cost traceability analysis is a method of identifying and tracking the sources and destinations of costs in a business process or a product. It helps to understand how costs are incurred, allocated, and distributed throughout the value chain. Cost traceability analysis can provide valuable insights for managers, customers, suppliers, and regulators from different perspectives. In this section, we will discuss the importance of cost traceability analysis from these four points of view and how it can benefit each stakeholder. We will also provide some examples of cost traceability analysis in different industries and scenarios.

Products

However, using ROI to evaluate division performance can lead to sub-optimal (or dysfunctional) decision-making. Therefore, a manager might choose not to invest in new assets, to avoid the apparent negative impact on performance. However, not investing in new assets in the short term could be damaging to a division’s competitive performance in the longer term.

EXAMPLE 2 – Calculating ROI and RIA company has two divisions, Division A and Division B. One potential solution to the issue of classifying controllable and non-controllable factors is to specify which budget lines are to be regarded as controllable and which are not. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. However, the head office is situated in Montreal, and that is where all the operations are headed.

Comparing performance between divisions – to compare the performance of different divisions, a measure needs to take into account variations in size or differing levels of investment. ROI enables this, because it shows percentages, so can be used to compared returns on divisions of different sizes. By contrast, RI is an absolute measure, which makes it difficult (but not impossible) to compare performance. The company’s weighted average cost of capital is 10%, and management believe this is appropriate for both divisions. ROCE can be useful for comparing the use of capital by different companies or divisions engaged in the same business. However, the value of any comparison (ROCE; ROI) will be affected by the similarities (or differences) between the entities whose performance is being measured.

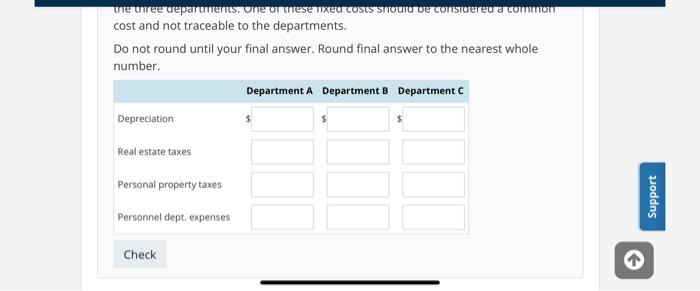

It also enables visibility into complex operations at the activity level to identify opportunities and make changes. And it helps benchmark costs of plants and regions to identify where supply chain metrics and trade spends can be improved. Some fixed costs that are considered traceable by one segment may be considered common costs by another segment. For example, a law firm funds a group malpractice insurance plan for each of its three individual branches. The cost of the malpractice insurance is traceable to each office, but not to each individual lawyer. Another example of a cost that is traceable and common is the landing fee to land an airplane.

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. A cost-to-serve approach is fundamental to how a holistic, forensic view of all costs can enable a company to position itself for today’s challenges.

To successfully adopt activity-based costing as one of your cost management solutions, it is crucial to follow a strategic sequence. The cost of plastic used in production can be easily traced to the food containers. However, the cost spent for electricity is not directly traceable to the food containers since such cost was not used solely for the production of the product.

In order to do this, we need to determine the cost centre that is related to the product. Fixed cost is the cost that will occur regular basis regardless of the production quantity. Fixed cost will not change based on the production while the variable cost will change depending on the number of production. Some costs are non-controllable, such as increases in expenditure items due to inflation. Capitalising value-building expenditure and spreading the cost over the periods in which the benefits from it are received, should reduce short-termist decision-making. For example, under EVATM, the marketing expenditure linked to the launch of Division B’s new product in our Example 2, would be capitalised, rather than expensed in 20X2.